The Role of Sentiment Analysis in Forex Trading

Market sentiment is one of the most overlooked yet powerful tools in Forex trading. While technical and fundamental analysis focus on price patterns and economic data, Forex sentiment analysis gives you insight into what traders are feeling and how they are positioning themselves.

Understanding market sentiment can help you spot trends early, avoid trading against strong momentum, and even take contrarian positions when the market is overly bullish or bearish. Let’s break down what sentiment analysis is, which tools help measure it, and how to use it in your trading strategy.

What is Sentiment Analysis in Forex?

Forex sentiment analysis is the study of how traders collectively feel about a particular currency pair. It helps answer key questions:

- Are traders mostly bullish (expecting prices to rise) or bearish (expecting prices to fall)?

- Is the market overbought or oversold?

- Are most traders positioned in one direction, creating a potential reversal opportunity?

Unlike technical analysis, which focuses on price action, or fundamental analysis, which looks at economic data, sentiment analysis gives you an inside look at trader psychology and positioning.

Tools for Measuring Market Sentiment

1. Commitment of Traders (COT) Report

One of the best sentiment indicators, the COT report, is published weekly by the Commodity Futures Trading Commission (CFTC). It shows how different groups of traders (hedge funds, commercial traders, and small speculators) are positioned in the market.

How to use it:

- If large speculators (hedge funds) are heavily long on a currency, the market may be overbought and due for a correction.

- If commercial traders (who hedge for business purposes) are positioned against the trend, it may signal a potential reversal.

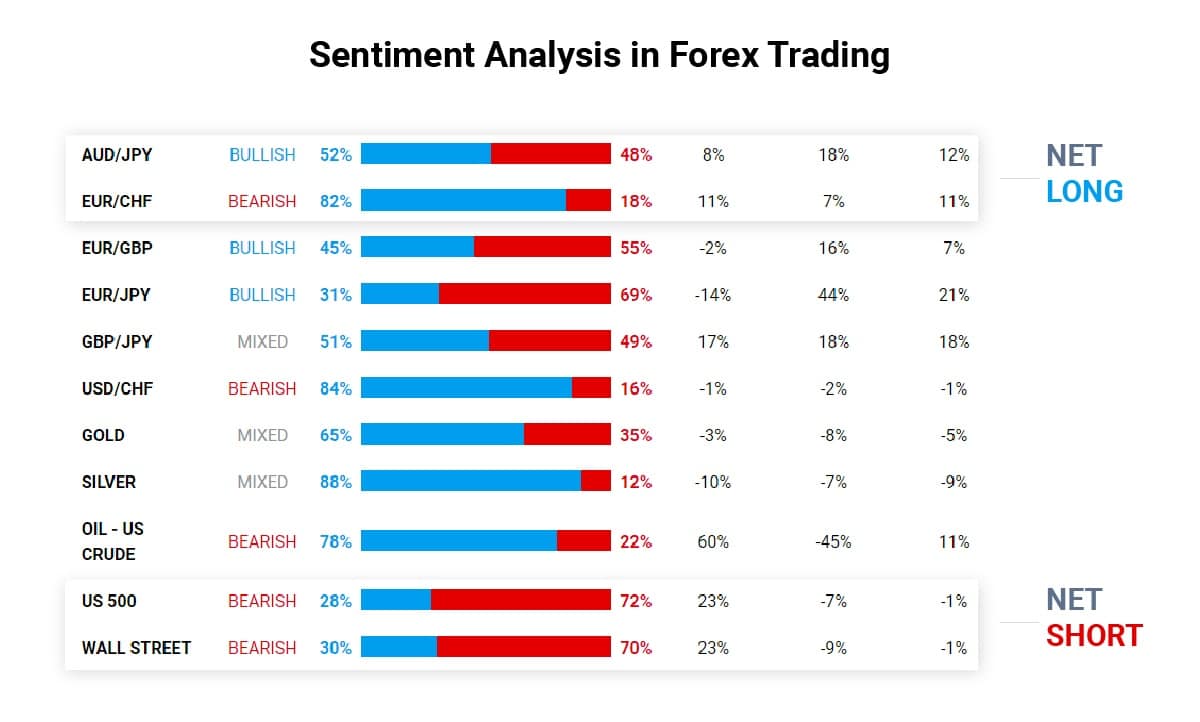

2. Forex Broker Sentiment Data

Many Forex brokers provide retail trader positioning data, showing what percentage of their traders are long or short on a currency pair.

How to use it:

- If 80% of retail traders are long on a currency, it might indicate that a reversal is coming.

- The majority of retail traders tend to be wrong at key turning points, so this data can be used in contrarian trading strategies.

3. Sentiment-Based Indicators

Some technical indicators incorporate sentiment into their analysis, such as:

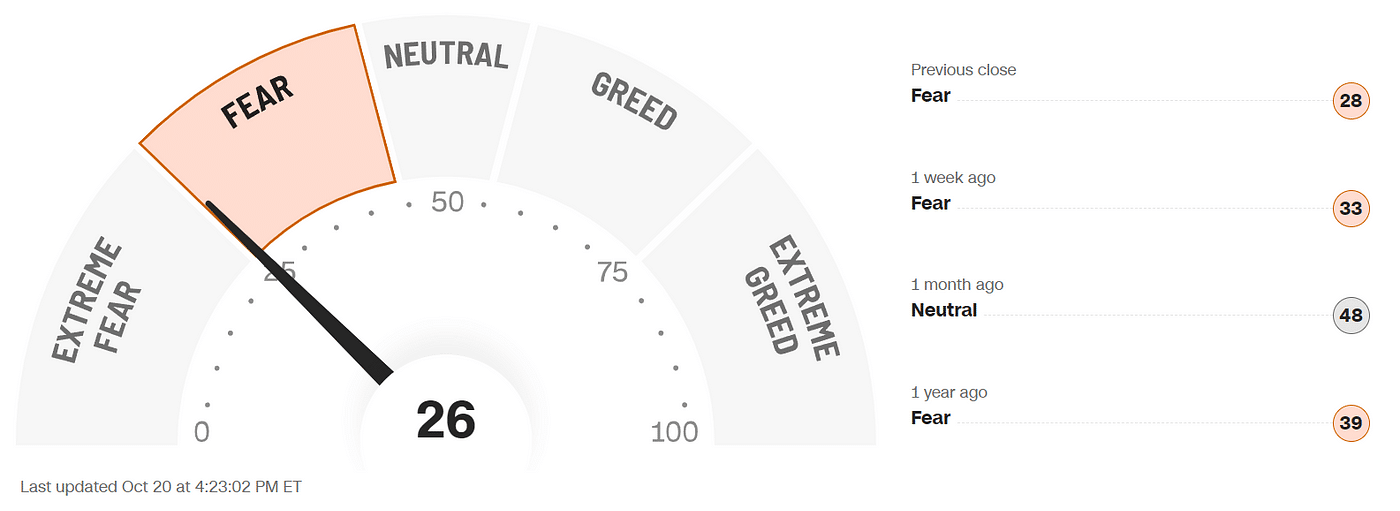

- Fear and Greed Index: Measures overall market sentiment and risk appetite.

- Put/Call Ratio: Helps gauge sentiment in currency options trading.

How to Incorporate Sentiment Analysis into Your Trading

Now that you understand how to measure sentiment, let’s talk about applying it to your trading.

- Trading with Market Sentiment

- When sentiment is strongly bullish, look for technical and fundamental confirmation before going long.

- When sentiment is strongly bearish, it may signal continued downward momentum.

- Contrarian Trading Strategy

Contrarian traders use sentiment analysis to trade against the majority when market sentiment reaches extreme levels.Example:

- If the COT report shows that large speculators are excessively long on EUR/USD, a contrarian trader might look for signs of a reversal and consider shorting the pair.

- Combining Sentiment with Technical and Fundamental Analysis

The best traders don’t rely solely on sentiment. Instead, they use it as an additional tool:

- If sentiment and technical analysis both signal a bullish trend → Higher probability trade.

- If sentiment is bullish but technical indicators show overbought conditions → Potential reversal signal.

Conclusion: Using Sentiment to Gain a Trading Edge

Forex sentiment analysis is a valuable tool that provides deeper insight into market conditions and trader psychology. By combining sentiment with technical and fundamental analysis, you can make more informed trading decisions and improve your overall strategy.